The landscape of wireless things: Business dynamics, vertical markets, LPWA technology, and industry challenges

March 06, 2017

The phenomenon of ubiquitous connected sensors providing key data and further processing of that data in the cloud to deliver business insights presen...

The phenomenon of ubiquitous connected sensors providing key data and further processing of that data in the cloud to deliver business insights presents a huge opportunity for many players in the electronics and software industry.

The Internet of Things (IoT) is less about wireless radios and technologies. It is more about the combination of key data transmitted by sensors and the post-processing of that data to deliver key business insights, resulting in efficiency and savings. There is now enough compute horsepower in a tiny ARM processor to make things more powerful than desktop PCs in the early 1990s, especially with unlimited, almost free cloud-based computing resources. This phenomenon, and advances in software, are enabling breakthroughs in machine learning and artificial intelligence (AI) to perform that post-processing.

Machine learning and AI are at the root of almost every money-making value proposition in IoT, as a thriving IoT relies on four crucial items:

- A viable business model

- A robust connectivity topology,

- Reliable sensors

- AI techniques to extract and deliver the right insights

Business dynamics of wireless data

The path from 3G to 4G to 5G data services for an operator is a path to becoming a converged faceless utility: the average revenue per user (ARPU) declines year-over-year; data consumed has risen exponentially; the revenue per MB has declined exponentially. Therefore operators are faced with making huge investments in infrastructure to support declining revenue streams, and over-the-top (OTT) providers, aspirations of big companies, and merger and acquisition (M&A) activity will further challenge operators as each has the potential to introduce services that will find users the cheapest connection on a minute-by-minute basis.

Hence the motivation for low-power, wide-area (LPWA) IoT technologies. There are hundreds of applications for which operators can charge from pennies to dollars per month. The data volume associated with these applications is tiny so the load on existing infrastructure is small. In the future it can be expected that operators will earn most or all of their profit from these new services based on LPWA technologies.

IoT technologies and applications

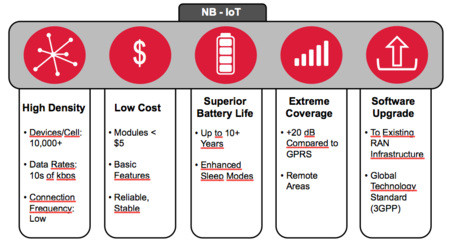

LPWA networks are designed to support machine-to-machine (M2M) applications with low data rates that are able to sustain long battery lives and operate unattended for years. There are many LPWA technologies, including NB-IoT, LoRa, and Sigfox. LTE Category-NB1 (formerly NB-IoT) is governed by 3GPP standardization and has widespread operator backing and infrastructure support.

NB-IoT will provide an alternative technology for utility meters, parking bay sensors, fire detection, security, etc. (Figure 1). All of these industries have existing networking technologies so NB-IoT won’t be transformative, but rather an enabler to make them more ubiquitous.

[Figure 1 | LTE Category-NB1 (formerly NB-IoT) defines an alternative networking technology for low-bandwidth Industrial IoT (IIoT) applications that will enable ubiquitous, low-cost connectivity.]

LPWA technologies change the business model for companies that want to stay connected to products in the field. Today, larger capital assets have cellular modems in them for usage tracking and predictive maintenance, however the usage of lower cost products is not easy to cover. NB-IoT in particular offers the potential for every product to be shipped with a built-in tag that will allow manufacturers to track usage, status, and gain insight for continuous product improvement and marketing, and do so in a way that doesn’t require network collaboration with an end user. As there is currently no way to find and track products that are switched off without the collaboration of customers’ or installing suppliers’ wireless network at the customer, NB-IoT tags are positioned to solve a significant challenge.

The number of applications that will benefit from LPWA technology are countless, and include stakeholders from an industrial battery vendor who wants to track usage of their batteries without the collaboration of the vehicle maker (forklift) to the end user (warehouse).

Influence of IoT on vertical industries

The IoT phenomenon has had a multi-dimensional influence on vertical industries in terms of quality of life and commercial value.

From a quality of life perspective, the promise of IoT is to take a big step in closing the gap between providing comfort and the efficiency, which required significant human resource in the past. By knowing ever more about us, companies will be able to surround us with helpful intelligence, orchestrating and managing every detail of our lives – banking, entertainment, commuting, purchases, healthcare, education, travel, and childcare. As a result, we are likely to see fewer advertisements for things we do not care about and spend less time searching for the things we do.

In commercial value proposition dimension, IoT enables energy and resource utilization efficiency, and there are hundreds of value-add opportunities in many vertical industries (Figure 2):

[Figure 2 | The Internet of Things (IoT) value proposition varies based on vertical market.]

- Truck driver feedback to save fuel

- Finding an empty parking space

- Predictive rather than prescriptive maintenance

- Self-learning production lines to optimize energy, minimize scrap, and improve yield

- Optimizing wind turbines and other energy assets

- Supply chain management (know where every item is in your supply chain at all times)

Many of the propositions mentioned can be delivered as services, enabling a whole new set of service companies. IoT enables the transition from capital expenditures (CAPEX) spending to operational expenditure (OPEX) spends, more aptly aligning with the sentiment, “I don’t want to own a music player, I just want to listen to music now.”

As the world moves to an outcome-based frame of mind, vertical industries will need to rethink their business models. We will see nearly all capital supply industries transform to service industries – e.g., self-driving cars, renting heavy-duty goods, etc.

The outcome economy also opens a third budget – not CAPEX or OPEX, but savings. For example, IoT companies targeting the mining industry might be able to reduce fuel costs and accidents resulting from operator fatigue, allowing the IoT company’s business model to be based on a royalty percentage of the savings achieved in mining operations. That is a win-win.

There is an argument that all commerce will move to outcome-based transactions, as no customer will want, or need, to take a risk that a product won’t deliver on its promised return. In the future, customers will purchase a result and the supplier will take risks based on whether they can deliver the outcome. This will open up a new type of financial market where suppliers will insure against the risk of not being able to meet promised outcomes.

The whole point of IoT is to take people out of process loops. The key is to look at end-to-end processes and remove people from having to go through process steps through the use of wireless sensors enabled by data analytics and machine learning.

Industry challenges

Industry challenges center around coming up with a viable business model, time to market, speed to revenue, and deploying reliable sensor networks. Sensor design challenges involve tracking evolving standards, device miniaturization, and signal integrity issues, as well as requirements around long battery life (7-10 years without battery change) and certification.

From a technical perspective, superior battery life in the range of several years is one of the design targets for all IoT device makers. They need to characterize device battery life and current drain under realistic operating conditions. Sensor makers also need to address signal integrity issues such as crosstalk as tighter interconnects become more prevalent with miniaturization.

From a business perspective, challenges vary depending on the IoT application. While cost is a major factor in consumer IoT applications such as wearables and home automation, industrial IoT applications such as smart grids, connected cars, and transportation require unfailing reliability, longevity, security, and the ability to operate devices with little or no human intervention.

Today there is a plethora of wireless formats available for IoT designs, which is not uncommon during periods of rapid innovation in a new space. Table 1 outlines high-level attributes for the industry to consider when selecting a wireless format, but is by no means an exhaustive coverage of all IoT radio formats.

[Table 1 | Several wireless formats are available to Internet of Things (IoT) device manufacturers, each with fundamental advantages and disadvantages.]

Market outlook

IoT is likely to be a significant enabler of many disruptive business models and market efficiency. Although we haven’t seen operators talk seriously about service models yet, a future seems likely in which operators could offer a box of tags to put on our bikes, cars, pets, kids, lawnmowers, and car keys powered by a ‘Find my X’ application for an extra $1 to $5 per month on our smartphone plans. This would equate to a roughly 25 percent increase in operator ARPU, and may ultimately be where really big IoT device volumes start being generated.

As the world moves to an outcome-based economy, it is inevitable that IoT powered by machine learning and AI will become a key enabler in connecting multiple vertical industries on a real-time basis, providing efficiency, savings, and flexibility that benefits both suppliers and consumers.

Keysight Technologies, Inc.

LinkedIn: www.linkedin.com/company/keysight-technologies

Facebook: www.facebook.com/Keysight

Google+: plus.google.com/+keysight

YouTube: www.youtube.com/user/keysight